"Believe me Martin, this won't work." He did not give me any chance to answer or ask why. But he emphasized his point: "I have been in production scheduling the past 25 years."

Then he shared his lessons learned: "No factory is like the other. Each manufacturer has its own processes. Hence, they all manage and schedule in a different manner. Production scheduling only works if you customize it. It needs to support the individual manufacturer's processes. This is common sense and you should trust me."

Well, this was not what I wanted to hear.

For almost two years, I had been making a consistent observation. This observation made me think I had a smart idea for a brand new product. Or even a new product category. I had been noodling on this idea for quite a while. Finally, I was confident enough to discuss it. And I dared to ask a recognized industry expert for feedback.

"But my discussions with many small make-to-order manufacturers speak a different language. They want something simple, something visual and … ", was my attempt to make my point again.

He didn't let me finish my thought. He was so convinced that I was on a completely wrong track, that he interrupted me again.

"Listen. There is no point in delivering production scheduling as a product. It requires to understand the individual processes and each client. Then consult them, and make a customized solution for them. Production scheduling is a solution business. It is nothing that you can deliver with one of these fancy software as a service apps."

OK, thanks for the advice, Mr. industry expert.

I wanted to discuss a state-of-the-art idea, not best practices of the 1999'ies.

When I left this meeting, I was 100% sure that building a new product would be a major chance for my company.

At the end, this conversation gave me the third and final sign to invest in building an easy visual production scheduling software - as software as a service (SaaS) product that runs "in the cloud".

This third and final sign is:

Sign no. 3 to invest into a new product development:

Sign no. 3 to invest into a new product development:

Build something of which the common sense says "this will not work"

The thinking is obvious, right? If everybody says "this will work", chances are high that somebody else already built this. Yet, if everybody is skeptical they might be right … or … you have the chance to enter uncharted territory.

So, the above was the triggering moment and third reason to decide building our just plan it software. just plan it enables a visual and easy production scheduling, and aims at making production scheduling to be more visual, easy-to-understand, and human.

Here is what happened before that moment, and here are also my reasons no. 1 and no 2. to invest into a new product development.

Where we came from: this is no start-up story. This about an incumbent breaking out of boundaries.

It might sound strange, but for us building a SaaS product was not a no-brainer. We are no venture capital backed startup. We are a small, German, and 40+ years old software company (with around 30 people). We decided to build the just plan it software from the operating cash flow we generate with our other software products.

[Note to myself: building a SaaS product from operating cash flow is worth another post ;-)]

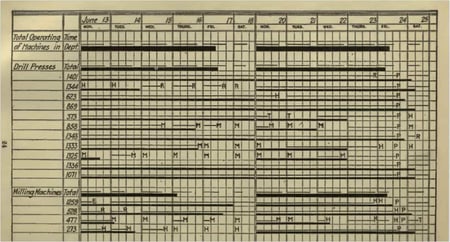

So: we are no start-up. Plus: when we started this journey, we also were no production scheduling experts. This is, where I wanted to get the advice from industry experts. The DNA of our company is to develop software to visualize time- and resource-centric planning data. We are software makers of the good, old Gantt charts.

So: we are no start-up. Plus: when we started this journey, we also were no production scheduling experts. This is, where I wanted to get the advice from industry experts. The DNA of our company is to develop software to visualize time- and resource-centric planning data. We are software makers of the good, old Gantt charts.

As a vendor of Gantt chart software components/controls, we always have been a product company. Also, being a product company, we have been selling globally (despite being fairly small).

More than 60% of our revenue comes from customers outside of Germany. That tells you that the DNA of our company is both software product and international business.

The 12 … 24 months before that meeting. The beast of chasing opportunistic revenue, and the beauty of understanding pattern.

In 2012 I started searching for new growth areas for our company, and decided against the obvious. We did not build new products for existing clients. Instead, we leveraged our core competence (interactive Gantt charts) and targeted a new market.

We built what we called 'visual scheduling' add-ins for an SMB ERP system (at that time: Microsoft Dynamics NAV). One for production scheduling, one for project & resource scheduling, and one for service order dispatching. Of course, we shipped these add-ins as software products and sold them globally.

This resulted in an effect, which came as complete surprise.

Our visual production scheduling add-in created serious traction outside the market we initially targeted. We got inquiries from manufacturers running on SAP, Sage, Epicor and other systems. We also got calls from production shops that seem to operate their company on Excel. They all came with the same question: "We saw the visual production scheduling you do for NAV. Can you do this for us as well?"

_pixabay%20small.jpg?width=450&name=roulette-1253622_1920%20(2)_pixabay%20small.jpg) I couldn't resist the temptation and opened Pandora's box. As maker of software development tools, I felt us ideally positioned to build individual solutions for these clients calling. So, we created custom scheduling solutions for a customer in a country on a system. Sometimes, they required a proof of concept and we developed a prototype for another customer in another country on another system.

I couldn't resist the temptation and opened Pandora's box. As maker of software development tools, I felt us ideally positioned to build individual solutions for these clients calling. So, we created custom scheduling solutions for a customer in a country on a system. Sometimes, they required a proof of concept and we developed a prototype for another customer in another country on another system.

Welcome to the world of software projects and custom developments. Big tickets, but also big risks. It felt a bit like gambling in the casino. In the end, the bank wins (and we were not the bank in that game). Risks were scaling faster than the business.

Time to stop gambling.

Time to increase what I call the cruising altitude. Getting out of the operational stuff. Seeing the bigger, but less granular pattern. Here is what I saw:

- There was global demand for something we called "visual production scheduling".

- It came (almost) independent of what system the customer used (everything from whiteboard to SAP).

- All manufacturers that approached us were SMBs.

- They all produced for a bespoke customer order, not for stock.

- Their quantities for production orders were tiny (batch size 1 more the rule, than the exception)

Holy shit!

Could it be that there is a rather homogeneous market segment out there? A market segment that got attracted by our visual production scheduler (which we built for NAV in the first place)? A market segment looking for some kind of production scheduling "system"?

Actually, that was the first sign I saw. A sign that made me think of building a visual production scheduling software as SaaS product.

Sign no. 1 to invest into a new product development:

Identify a large enough customer group with a homogeneous need

When speaking B2B (as is true for my case), this "large enough customer group" is either a (micro) vertical and/or customers that have similar processes. Ideally, it has a global representation and their need is rather homogeneous across borders.

Seeing sign no. 1, I immediately stopped gambling. I stopped taking opportunistic revenue (by building custom solution). Instead, I tried to understand what made these companies turn to us. Production scheduling is no new topic. Production scheduling software has been around for decades. Actually, there is software category called APS - advanced planning and scheduling software.

So, if all of this has been existing … why the heck did these guys reach out to us?

What stood out to me was the fact that we were consistently speaking about visual production scheduling. Well, we even named our NAV-centric product like this: Visual Production Scheduler.

So - time to change the cruising altitude. Let's get from "flying high" to "diving deep".

In my case, a deep dive translates into: understanding the customer, understanding the reason why the reached out to and understanding the job to be done. Here is what I learned by talking to our customers and prospects:

- They did not care (that much) about optimized resource utilization (which I had thought to be the core of all production scheduling/optimization solutions).

- Instead, they were heavily concerned about delivery times. Actually for two reasons.

- First, there a lot of make-to-order manufacturers out there. If they deliver late, next time the shop next door gets the order from their customer.

- Second, when they got an inquiry from their customer, they could not easily answer the most important question: "when will you be able to deliver"?

They lacked visibility into what was happening in their shop - not from a utilization point of view, but from a delivery point of view. They lacked an easy-to-get AND easy-to-understand answer to the question: "If I squeeze in this rush order, how will this impact the delivery times for all my other orders?"

As long as these companies are flying blind with respect to delivery times and delivery time velocity, they not just run danger to lose business. They lose customers. They lose business. They cannot grow as fast as they want to do.

Can you see it? This was the obvious second sign.

Sign no. 2 to invest into a new product development:

You have the (super) power to remove an obstacle that hinders the growth of your clients

Well, with the evidence of sign no. 1 and sign no. 2, I became excited. I scented a chance for us to build a SaaS product as new growth engine for our company. I became so excited that I asked some industry experts for their opinion and advice.

This brings me to the beginning and also the end of this blog.

If you find a large enough customer group with a homogeneous need, try to understand the mechanics behind.

If they look for a way to remove a growth road-blocker, check if you can help in a new way.

If then common sense tells that your way won't work, go for it.

That way, we learned that production scheduling was broken for make-to-order manufactures and job shops. We started fixing it with just plan it - a visual, and hence and human easy production scheduling software.

This article was first published in the just plan it SMB production scheduling blog.